Happy Pera

- You must be 18+

- Reside in the Ph and have a valid ID

- Provide proof of your income

- Have an active checking account

- Bank account

- Credit or Debit card

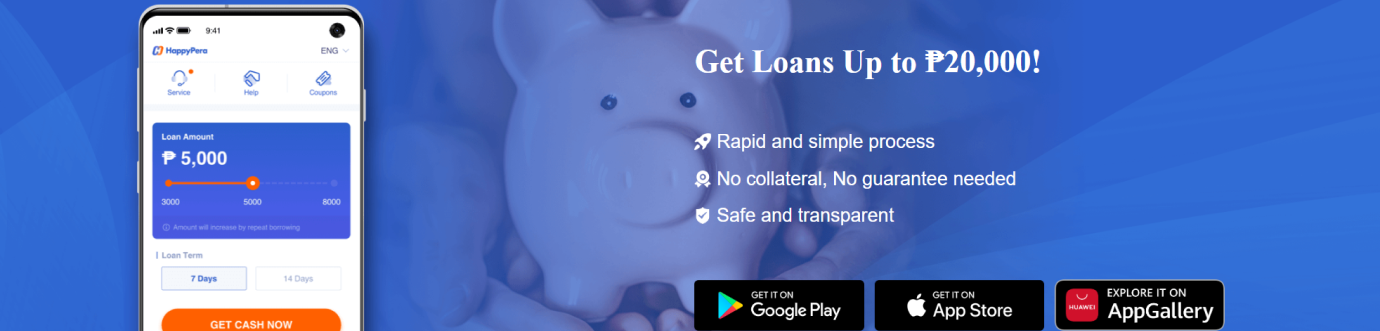

Happy Pera is an online money lending service that provides fast and easy approvals. It is an excellent option for people who need a small loan to cover urgent expenses. Its loan application is quick and simple, and it does not require a credit check or collateral. The company also offers guidance on managing finances to help its customers save and spend wisely.

The company is licensed as a business enterprise by the Securities and Exchange Commission (SEC). Its license number is CS201906145. In addition, it is a member of the Philippine Deposit Insurance Corporation (PDIC). Its license and membership are proof that the company adheres to the rules and regulations of the SEC and PDIC. In addition, the company has an excellent customer service team that is available round-the-clock to answer questions and concerns.

Moreover, the company also has a strict set of lending policies that are designed to protect its borrowers. In addition, the company does not lend to people with poor credit history or those who have an outstanding debt.

In addition to these requirements, the company has a revolving loan program that allows its borrowers to make multiple payments on their loans. This allows borrowers to manage their debts more easily and quickly, and it can also be a great way to get back on track after falling behind on your payments.

-

Loan amount1.000 - 12.000 PHP

-

Interest rate0.03% per day

-

Term91 - 120 days

-

Age18+ years

How to apply for an online loan

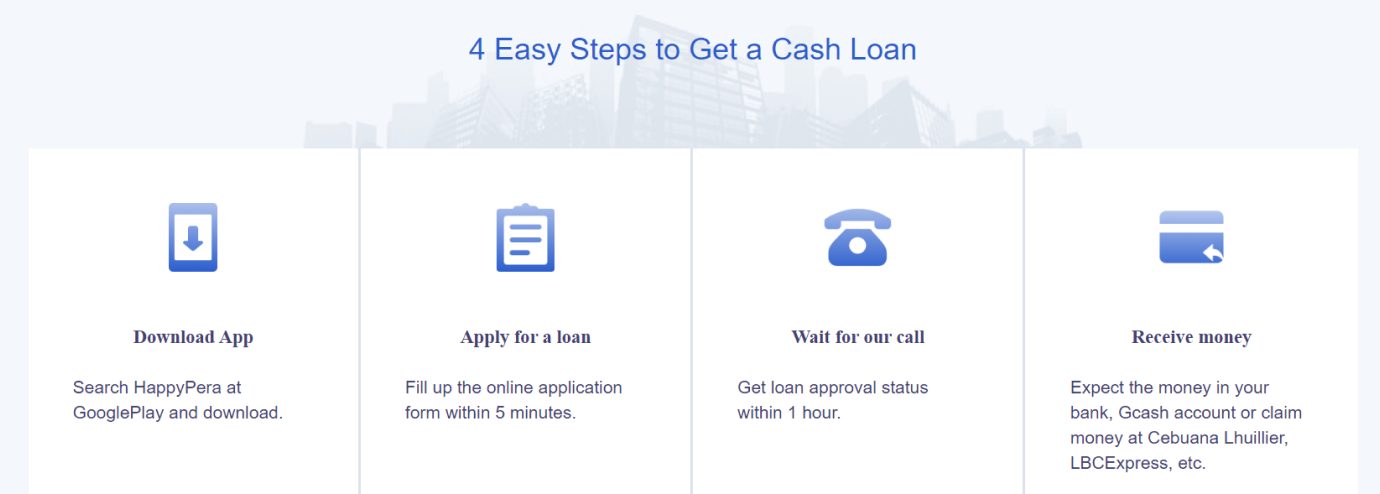

Happy Pera In The Philippines is one of the leading online lenders in the country that offers fast and convenient loans to Filipinos. Applying for a loan from Happy Pera In The Philippines is easy and hassle-free, and can be done in just a few simple steps.

Step-by-Step Guide on the Application Process

- Visit the Happy Pera In The Philippines website. The first step to apply for an online loan from Happy Pera In The Philippines is to visit their website at www.happypera.ph.

- Choose the loan amount and repayment terms. Once you are on the website, choose the loan amount and repayment terms that you prefer. Happy Pera In The Philippines offers loans ranging from ₱5,000 to ₱50,000, with repayment terms of 3 to 12 months.

- Fill out the online application form. After choosing the loan amount and repayment terms, fill out the online application form with your personal and financial information. Make sure to provide accurate and complete information to avoid delays in the processing of your loan application.

- Submit the required documents. To complete your loan application, you will need to submit the required documents such as a valid ID, proof of income, and bank statements. Make sure to have these documents ready and upload them on the website.

- Wait for the loan approval. Once you have submitted your loan application and required documents, wait for the loan approval. Happy Pera In The Philippines will notify you through email or SMS once your loan has been approved.

- Receive the loan disbursement. After your loan has been approved, you will receive the loan disbursement through your bank account or through a cash pickup.

Required Documents and Information

To apply for an online loan from Happy Pera In The Philippines, you will need to submit the following documents and information:

- Valid ID – such as a passport, driver’s license, or government-issued ID.

- Proof of income – such as payslips or bank statements.

- Bank statements – to verify your bank account and transaction history.

- Personal information – such as your name, address, and contact details.

Tips on How to Increase Your Chances of Approval

To increase your chances of getting approved for an online loan from Happy Pera In The Philippines, here are some tips to keep in mind:

- Make sure to provide accurate and complete information on your loan application.

- Have a stable source of income and a good credit history.

- Choose a loan amount and repayment terms that you can comfortably afford.

- Submit all the required documents and information on time.

- Avoid applying for multiple loans at the same time as this can negatively affect your credit score.

- Easy and Convenient Application Process: Happy Pera offers a user-friendly online platform that allows for a quick and hassle-free loan application process. With just a few simple steps, you can complete your application and receive a loan decision promptly.

- Fast Approval and Disbursement: Happy Pera understands the importance of quick access to funds. They strive to provide fast approval and disbursement, ensuring that you can receive the money you need in a timely manner, often within the same day.

- Flexible Loan Options: Happy Pera offers a range of loan options with flexible repayment terms. Whether you need a short-term loan or a longer-term installment loan, you can find an option that suits your financial needs and repayment capabilities.

- Transparent and Fair Terms: Happy Pera is committed to transparency and fairness in their loan terms. They provide clear information about interest rates, fees, and repayment schedules, allowing you to make informed decisions and avoid any surprises.

- Limited Loan Amounts: Happy Pera's loan amounts may be limited compared to some other lenders. If you require a higher loan amount, you may need to explore alternative lending options.

- Eligibility Criteria: While Happy Pera aims to provide access to loans to as many individuals as possible, there are certain eligibility criteria that need to be met. This may include age requirements, employment status, and other factors that could impact your eligibility for a loan.

- Interest Rates and Fees: It's essential to carefully review and understand the costs associated with borrowing from Happy Pera to ensure it aligns with your budget and financial goals.

- Online-Only Service: Happy Pera operates solely as an online lending platform, which means all interactions, applications, and loan management are conducted through their website or mobile app. If you prefer in-person assistance or a physical branch presence, this may not be the ideal option for you.

Conclusion

Happy Pera In The Philippines understands the importance of having access to reliable and affordable loans. That’s why they offer a range of loan options that cater to different financial needs. Whether you need extra cash for unexpected expenses or want to fund your business dreams, Happy Pera In The Philippines has got you covered. Apply for an online loan in Happy Pera In The Philippines today and experience the convenience of borrowing money from a trusted and reputable lender.

Best Loans

Happy Pera reviews

Testimonials

Applying does NOT affect your credit score!

No credit check to apply.