PeraMoo is a modern, efficient, and secure online lending platform tailored for individuals in need of financial assistance. Whether it’s covering school fees, buying airtime or data, paying for cable TV or internet, or handling unexpected daily expenses, PeraMoo ensures you have the financial flexibility to meet your needs. Recognizing the growing demand for quick access to funds during challenging times, this service was thoughtfully designed to bridge the gap between financial need and convenience.

What is PeraMoo?

PeraMoo loans are user-friendly, short-term, and unsecured, making them an excellent choice for Filipinos seeking quick financial solutions. Borrowers can access amounts of up to ₱10,000 with repayment terms ranging from 91 to 360 days. The annual interest rate is highly competitive, falling between 10% and 26%, while service fees vary from 5% to 15% of the loan amount.

Applying is straightforward and can be done via the PeraMoo mobile app or website, offering a seamless borrowing experience for users across the Philippines.

-

Loan amount2.000 - 10.000 PHP

-

Interest rate0,1% per day

-

Term91— 360 day

-

Age21+ years

-

ApprovalDuration day to day

Is PeraMoo Legit?

Yes, PeraMoo is a fully legitimate online lending service in the Philippines. Operated by Magician of Money Lending Corp., the platform is officially registered with the Securities and Exchange Commission (SEC). This registration guarantees that the company complies with all regulatory standards, providing borrowers with a trustworthy and transparent lending experience.

Key Details of PeraMoo’s Registration

| Company Name: | Magician of Money Lending Corp. |

| Registration Number | CS201918391 |

| Certificate of Authority | 3157 |

| Anniversary Date | November 7, 2019 |

| Interest Rate | 0.83% per month |

As listed on the SEC’s registry of licensed lending platforms, PeraMoo operates under strict regulations and has passed all required audits. Borrowers can confidently rely on this service for their financial needs.

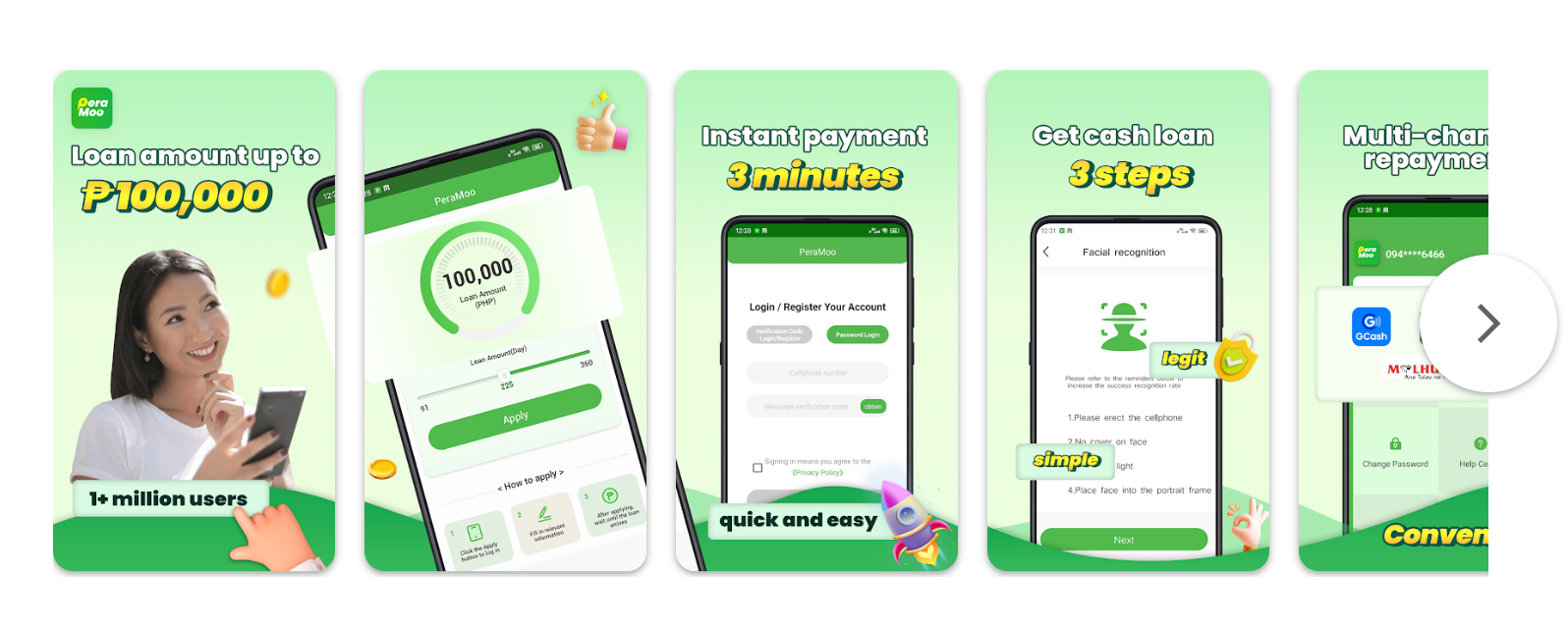

The PeraMoo Loan App

Designed specifically for borrowers in the Philippines, the PeraMoo mobile app offers a fast, simple, and stress-free loan application process. Managed by the experienced Magician of Money Lending Corp., the app is a licensed tool for accessing secure financial services.

The PeraMoo Philippines APK can be downloaded for free directly from the official PeraMoo website. Through the app, eligible users gain access to convenient borrowing solutions, ensuring that financial support is always just a few taps away.

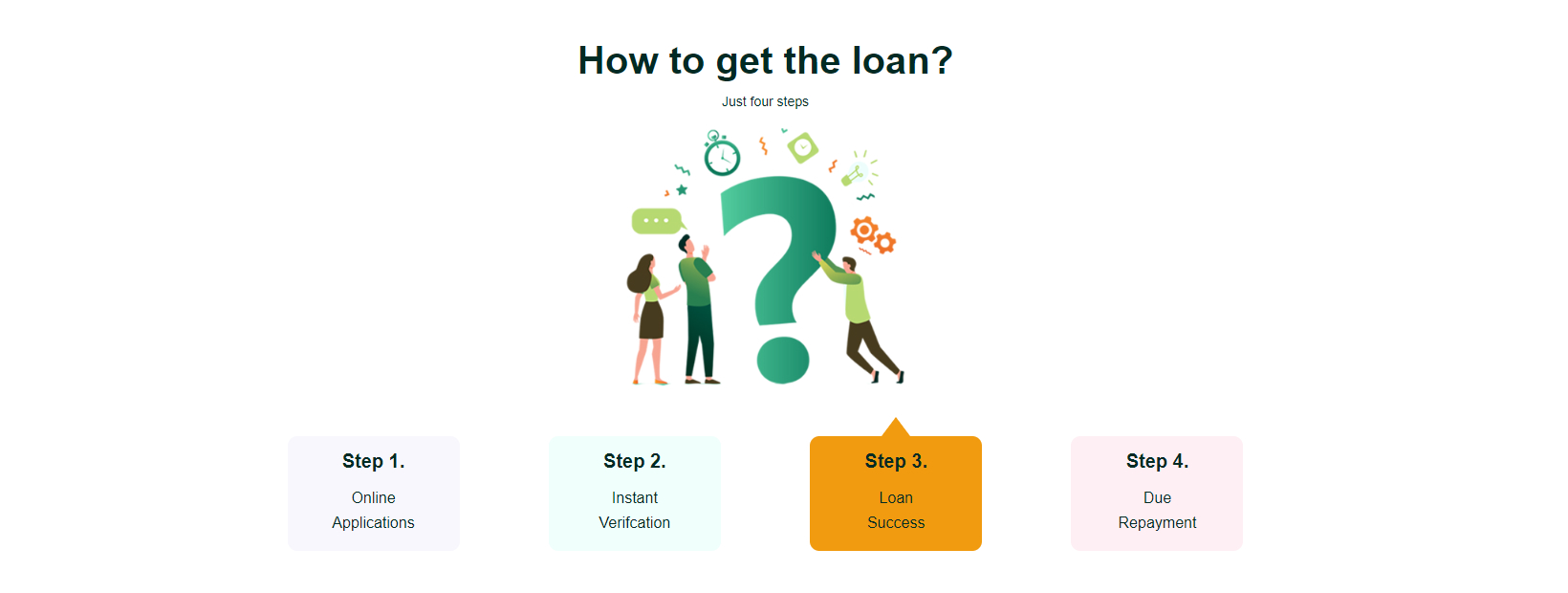

How to Get a Loan with PeraMoo

PeraMoo provides a fast, convenient, and reliable solution for securing a personal loan exactly when you need it. Designed under the legal framework of the Republic of the Philippines, the platform operates via the trusted Magician of Money Lending Corp. PeraMoo offers safe, affordable, and efficient online lending services, enabling borrowers to access funds in pesos with ease and confidence.

If you’re wondering how to get started with PeraMoo, follow this simple step-by-step guide:

- Download the PeraMoo Loan App. Access the PeraMoo application on the Google Play Store or the App Store for free.

- Create an Account. Sign up using your phone number, email address, and a secure password to start the registration process.

- Provide Personal Details. Fill out your profile with essential information, including your name, date of birth, residential address, and current occupation.

- Select Loan Amount and Term. Choose a loan amount ranging from ₱2,000 to ₱10,000 and a repayment period between 91 and 360 days based on your needs.

- Review Loan Terms and Conditions. Carefully read through the loan terms and conditions. Confirm your agreement to proceed with the application.

- Application Processing. Submit your application and wait for processing. The review typically takes a few hours to a couple of days.

- Receive Your Loan. Once approved, your loan amount will be transferred directly to your bank account or e-wallet, ensuring quick access to the funds.

Loan Requirements

To be eligible for a PeraMoo loan, applicants must meet specific criteria that ensure financial responsibility and compliance with local regulations:

- Age Requirement: Applicants must be at least 18 years old, confirming their legal ability to engage in financial agreements.

- Citizenship: Loans are available exclusively to Filipino citizens, aligning with local legal standards.

- Stable Income: Demonstrating a steady income stream is critical to prove the borrower’s capacity to repay the loan on time.

By meeting these simple requirements, borrowers position themselves for a seamless approval process and access to the financial support they need.

How to Cancel a PeraMoo Loan

Canceling a PeraMoo loan is straightforward but requires adherence to specific steps. Here’s how to proceed:

- Contact Customer Support. Reach out to PeraMoo’s customer service team via their official email address or phone number.

- Request Cancellation. Inform the customer service representative about your intent to cancel your loan. Be clear and provide all necessary details.

- Verify Your Identity. The representative will request your loan account details and perform identity verification to process your request.

- Await Confirmation. After verification, your cancellation request will be processed. You’ll receive a confirmation email or SMS stating that the loan has been canceled.

Important Notes:

- A cancellation fee may apply depending on the terms outlined in your loan agreement.

- If you face any challenges during the cancellation process, consider contacting the Securities and Exchange Commission (SEC) of the Philippines for additional support.

How to Increase Your PeraMoo Loan Limit

Expanding your loan limit with PeraMoo is possible by demonstrating responsible borrowing and maintaining a positive credit history. Here are actionable steps:

- Build a Solid Repayment History. Ensure timely repayment of your current loans. A strong repayment track record signals your reliability as a borrower.

- Strengthen Trust with PeraMoo. Adhere to all terms and conditions, avoid late payments, and consistently show that you can manage loans responsibly.

- Request a Loan Limit Increase. Contact PeraMoo’s customer service and inquire about increasing your loan limit. Provide any necessary documents to support your request.

If your request is denied, focus on improving your credit profile. After a few months of consistent repayment, you can reapply for a higher limit.

PeraMoo Loan Extension

PeraMoo offers flexible loan extensions to help borrowers manage their repayment schedules. For example, if you have a ₱3,000 loan for 7 days at 0% interest, an extension will cost ₱525.

How to Extend Your Loan:

- Log in to your PeraMoo account.

- Activate the extension option.

- Select the desired extension period: 7, 14, 21, or 30 days.

Key Details:

- Extensions are available both before and after the payment due date.

- The cost of the extension depends on the loan amount.

- This is a paid service, so review the fees carefully before confirming.

How to Pay a PeraMoo Loan

PeraMoo offers multiple convenient payment methods to ensure borrowers can easily settle their loans. Among the most popular options are:

- BPI Cash Payment

- BPI Online Banking

- Landbank ATM Online

- Landbank Cash Payment

- Metrobank Cash Payment

- Metrobank Online Banking

- Cebuana Lhuillier Bills Payment

- LBC and i2i Rural Banks

The most widely used method in the Philippines is through Gcash, which allows borrowers to complete their payments in just six simple clicks. This method is popular for its ease of use and reliability, with borrowers rarely encountering issues.

What Happens If I Have an Unpaid PeraMoo Loan?

If you’ve missed your loan payment or are facing challenges in repaying your PeraMoo loan, it’s crucial to take action promptly:

- Contact Customer Support: PeraMoo’s support team is available daily from 8 AM to 5 PM to assist borrowers with repayment issues.

- Seek Immediate Guidance: The customer service team will provide clear instructions on how to address the situation and avoid escalation.

Prevent Disputes: It’s always advisable to resolve payment delays proactively to maintain a positive relationship with the lender and safeguard your credit standing.

PeraMoo Harassment

PeraMoo is a legitimate, registered lending company in the Philippines and adheres strictly to legal practices when collecting debts. However, if your credit agreement includes collaboration with collection agencies, you may receive follow-up calls from their representatives.

To minimize stress and avoid potential harassment:

- Borrow Responsibly: Only apply for loans from licensed lenders like PeraMoo.

- Repay on Time: Staying up-to-date with payments eliminates the need for collection efforts.

PeraMoo and its affiliated agencies operate within the bounds of Philippine law, ensuring borrowers are treated fairly while encouraging repayment of debts.

What Happens If I Don’t Repay My PeraMoo Loan?

Failure to repay a PeraMoo loan can lead to the following consequences:

- Debt Collection: Representatives may contact you or the references provided during your application. They may reach out via phone calls to remind you about the outstanding amount.

- Credit Impact: Unpaid loans negatively affect your credit history, reducing your credit score and making it more challenging to secure loans in the future.

- Legal Action: Persistent non-payment could result in the company filing a case against you, as outlined in the loan agreement.

Potential Penalties: Under Philippine law, borrowers may face fines ranging from ₱10,000 to ₱50,000, imprisonment of six months to ten years, or both, as determined by the court.

PeraMoo Processing Fees

For new customers, PeraMoo provides interest-free loans without additional processing fees. However, during the loan approval process, minor administrative costs may apply:

- Fees: These range from 0.50% to 2.50% of the total loan amount.

- Evaluation Criteria: PeraMoo evaluates borrowers’ credit scores to assess creditworthiness, which plays a significant role in determining loan approval and terms.

PeraMoo generates revenue through the repayment of loans, which includes recovering both the principal and interest. By maintaining transparency and fair practices, PeraMoo ensures a smooth borrowing experience for all its customers.

PeraMoo Customer Service

PeraMoo prioritizes customer support to ensure a seamless borrowing experience. The platform is operated by Magician of Money Lending Corp., a trusted name in financial services.

Operating Hours: 8:00 AM to 5:00 PM, Monday to Friday

Head Office Address:

UNIT 2/C, Murphy Center,

187 Bonny Serrano Road, Socorro,

Quezon City Second District, NCR, Philippines 1109

NOTE PeraMoo operates entirely online and does not have physical branches. All loan-related inquiries and transactions are handled through the app or website.