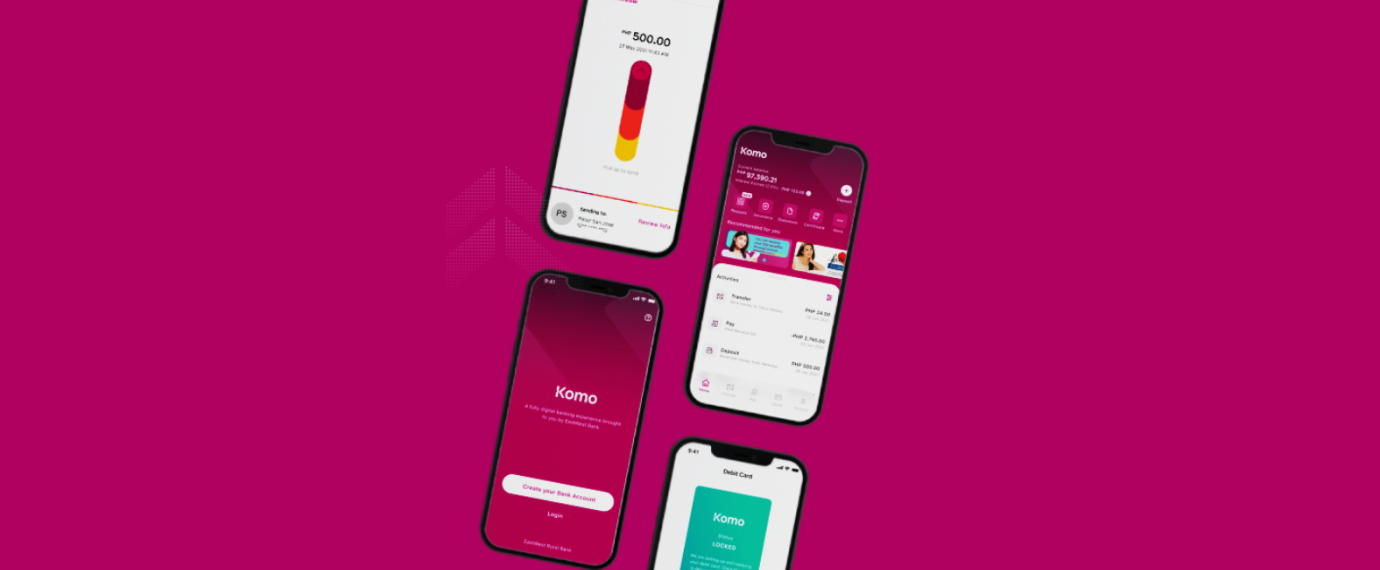

Komo by EastWest

- You must be 18+

- Reside in the Ph and have a valid ID

- Provide proof of your income

- Have an active checking account

- Bank account

- Credit or Debit card

In today’s fast-paced world, everything is going digital, including banking services. Online loans are becoming increasingly popular, offering a convenient and efficient way to access funds without leaving your home. Komo Philippines is one of the leading providers of online loans in the Philippines, offering a range of customizable loan options to meet your financial needs.

Online Banking has revolutionized how we manage our finances, offering a fast, convenient, and secure way to access your money from anywhere in the world. Komo, a digital banking service, exemplifies this modern approach to banking. It offers high-interest savings accounts that make your money work harder for you. Along with this, Komo loan provides a Visa debit card, enhancing the flexibility and convenience for its users.

Komo, for example, is a digital bank in the Philippines that provides customers with banking services via its mobile app. The company is a subsidiary of East West Rural Bank, which offers a range of products and services that are tailored to the needs of Filipinos. This includes savings accounts, loans, and insurance policies. The company also allows its customers to invest in government treasury bonds

Komo Philippines offer loans to people with varying credit scores, making it easier for more people to access funds when they need them.

Komo Philippines offers a range of online loan options to suit different financial needs. For example, they offer personal loans that can be used for a range of purposes, including debt consolidation, home renovations, or even funding a wedding. They also offer business loans for entrepreneurs and small business owners who need to access funds to grow their business.

-

Loan amount10,000 - 1,000,000 PHP

-

Term3 - 36 months

-

Interest ratevariable

-

Age18+ years

Komo loan application

When it comes to online banking, Komo is a unique platform that enables customers to make deposits, save money, and manage their accounts without visiting any physical branch. It also offers convenient insurance solutions to help protect their assets. However, like other online platforms, Komo is vulnerable to cyberattacks. Although the company secures its systems, users should still be cautious about transferring their personal information online.

The process of applying for a personal loan can be daunting. To simplify the process, it is best to prepare all the necessary documents ahead of time. This will help you avoid any delays or complications during the processing of your application. You should also know that different lenders have their own set of requirements. For example, some lenders require a fully accomplished application form, proof of income, and valid ID. Moreover, some lenders may also require a co-maker or collateral.

Step 1: Visit the Komo Philippines website

To apply for a loan from Komo Philippines, visit their website at komoph.com. Once there, click on the “Apply Now” button on the homepage.

Step 2: Fill out the application form

Next, you will need to fill out the online application form. This will require you to provide personal information such as your name, address, and contact details. You will also need to provide information about your employment status and income.

Step 3: Upload your supporting documents

To complete your application, you will need to upload supporting documents such as a valid ID, proof of income, and proof of address. Make sure that these documents are clear and legible to avoid any delays in processing your application.

Step 4: Wait for the loan approval

Once you have submitted your application and supporting documents, all you have to do is wait for Komo Loan to review your application. If your application is approved, you will receive an email notification with the details of your loan.

To increase your chances of getting approved for a loan from Komo Philippines, make sure that you have a good credit score and a stable source of income. Additionally, make sure that you provide accurate and complete information on your application form and supporting documents.

Komo Philippines considers a variety of factors when reviewing loan applications. These include your credit history, income, employment status, and debt-to-income ratio. They also take into account your reasons for borrowing and the amount of the loan that you are requesting.

The application process for a Komo personal loan is fast and easy. The process requires only a few simple steps, and it takes about 10 minutes to complete. You’ll need to fill out an application form, provide proof of income and sign your application. Then, the bank will review your application and issue a decision. Once approved, you’ll receive a notification via email.

- Convenient Digital Banking: Komo offers a fully digital banking experience, allowing you to access your accounts and perform transactions anytime, anywhere.

- Competitive Savings and Deposits: Komo provides competitive interest rates on savings and deposit products, helping you grow your money faster.

- Quick and Easy Loan Application: Applying for loans through Komo is fast and straightforward, with simplified processes and swift approval.

- Limited Branch Network: Since Komo operates primarily as a digital banking platform, there is a limited physical branch network for those who prefer in-person banking services.

- Relatively New in the Market: As a relatively new player in the market, Komo may not have the same level of brand recognition and reputation as more established banks.

- Limited Range of Financial Products: While Komo offers essential banking services like savings accounts and loans, their product range may be more limited compared to traditional banks that offer a wider variety of financial products and services.

Requirements for applying for Komo loan

In today’s fast-paced world, financial needs can arise at any time. Whether it’s for emergency medical expenses, home repairs, or funding a new business venture, having access to quick and convenient financing options can make a world of difference. This is where Komo Philippines comes in, a leading financial services company that offers online loans to Filipinos in need of financial assistance.

If you’re considering applying for an online loan from Komo Philippines, there are certain requirements that you need to meet in order to qualify. In this blog post, we’ll take a closer look at these requirements and why they are necessary for the loan application process.

- Age: You must be at least 21 years old. This is a standard requirement for any loan application, as it ensures that the applicant is legally allowed to enter into a financial agreement. Additionally, Komo Philippines requires that applicants be no older than 65 years old at the time of loan maturity.

- Income: You must have a stable source of income. This is to ensure that you have the means to repay the loan. Komo Philippines requires that applicants have a minimum monthly income of Php 15,000. This amount may vary depending on the type of loan you’re applying for.

- Employment: Be employed and have a minimum of six months’ tenure with their current employer. This requirement is necessary to ensure that the applicant has a stable work history and is less likely to default on the loan.

- Credit Score: Komo Philippines also considers the applicant’s credit score when evaluating loan applications. A credit score is a numerical representation of a person’s creditworthiness based on their credit history. A good credit score indicates that the applicant is responsible with their finances and is less likely to default on the loan. Komo Philippines requires a minimum credit score of 550 for loan approval.

- Valid ID and Proof of Address: To verify your identity and address, Komo Philippines requires that applicants submit a valid government-issued ID and a proof of billing or residence. This requirement is necessary to ensure that the loan is not being taken out fraudulently.

Fees

Unlike traditional banks, digital banking does not have fees such as transaction charges, initial deposit, or maintaining balance. It also offers higher interest rates on savings accounts and virtual debit cards. Additionally, it is more convenient and accessible as most people are online now. Moreover, the Philippines is a good market for digital banking services because it has young demographics and a large untapped potential. Despite this, digital banks face challenges in competing with the established players in the country’s banking industry.

If you want to open a Komo account, you must first register your mobile number and provide a valid ID. After that, you can log into the app and choose a savings or checking account. You can also select the amount of money you wish to transfer from your existing bank account to your Komo account. You can also check your account balance and set up recurring transactions, such as online shopping or bills payment.

The app’s security features are another plus. Users can create a PIN to access the app and a password to protect their account from unauthorized access. In addition, they can choose a security question and answer to verify their identity when making an online transaction. This way, they can prevent anyone from hacking their accounts and stealing their money.

Users can deposit funds into their Komo account using a PesoNET or InstaPay transfer. PesoNET has no transaction fee, while InstaPay has a PHP8 fee per transfer. Tonik’s fees are also fairly low, charging only a production fee and a delivery charge for physical cards. Moreover, they can save on ATM withdrawals and online purchases with its free cashback feature.

Fees for Komo Philippines online loans include an application fee of ₱300 and a disbursement fee of ₱50. These fees are charged upfront and deducted from the loan amount. In addition, Komo Philippines charges a late payment fee of 5% of the overdue amount or ₱500, whichever is higher. This fee is charged for every day the payment is overdue.

As for the interest rates, Komo Philippines offers a range of rates depending on the loan amount and repayment terms. For loans with a term of 7 to 30 days and a loan amount of ₱2,000 to ₱10,000, the interest rate is 3.5% per week. For loans with a term of 31 to 60 days and a loan amount of ₱2,000 to ₱10,000, the interest rate is 3.3% per week. For loans with a term of 61 to 180 days and a loan amount of ₱10,001 to ₱30,000, the interest rate is 2.5% per week. These interest rates are relatively competitive compared to other lenders in the Philippines.

Compared to other lenders, Komo Philippines’ fees and interest rates are reasonable.

In conclusion, after reading the Komo loan review offers reasonable fees and interest rates for online loans. They are relatively competitive compared to other lenders in the Philippines. However, before applying, it is important to understand the fees and interest rates associated with the loan. Be sure to calculate the total cost of the loan, including fees and interest, to determine whether it is affordable for you.

Michael Dumaloan | Modified date: March 09, 2023

Best Loans

Your comment

Testimonials

Applying does NOT affect your credit score!

No credit check to apply.